Minimize Energy. Simplify the Process.

Minify = Minimize + Simplify. Minify Energy makes it easy to understand your current energy costs and where to start reducing consumption, saving money, and increasing the value of your building. Minify Energy helps minimize energy consumption and costs while improving indoor environments, productivity, property value, operational efficiencies, and global sustainability.

Identify > Incentivize > Finance > Complete

Energy Efficiency

LED Lighting

Now is the Time to Upgrade to LED Lighting. LED offers high-quality lighting, enhancing the comfort and safety of your environment, with significant energy savings (50%+) year-over-year to greatly reduce your operating expenses. Right now, unprecedented incentives make it the smartest time to upgrade.

Smart Building Control

Achieve both energy savings and improved comfort and productivity through optimized IAQ, temperature, pressure, humidity, lighting and occupancy management. With monitoring, alerts, adjustments and diagnostics you can efficiently manage properties remotely with data-informed decisions or automation thereby reducing maintenance and service expenses in the process.

Efficient HVAC

Whether dealing with chillers, boilers, RTU’s, Air Handling Units to Energy Recovery Ventilators (ERVs), Variable Frequency Drives (VFDs), efficient motors, or Power Factor Correction, Minify Energy can help you assess and optimize your HVAC efficiency, delivering a healthy, safe, comfortable and productive environment for occupants and achieving operational value for building owners and mangers.

Building Envelope & Insulation

Your building envelope - from roof to walls, doors and windows - affects the energy efficiency for heating and cooling. Minify Energy can help you assess your building and identify opportunities to improve your R value.

Water Conservation

For many building owners, particularly those who operate multi-family buildings, water can be the highest utility bill you pay. Minify Energy helps assess and reduce your water bills while still maintaining optimal plumbing needs.

Renewables

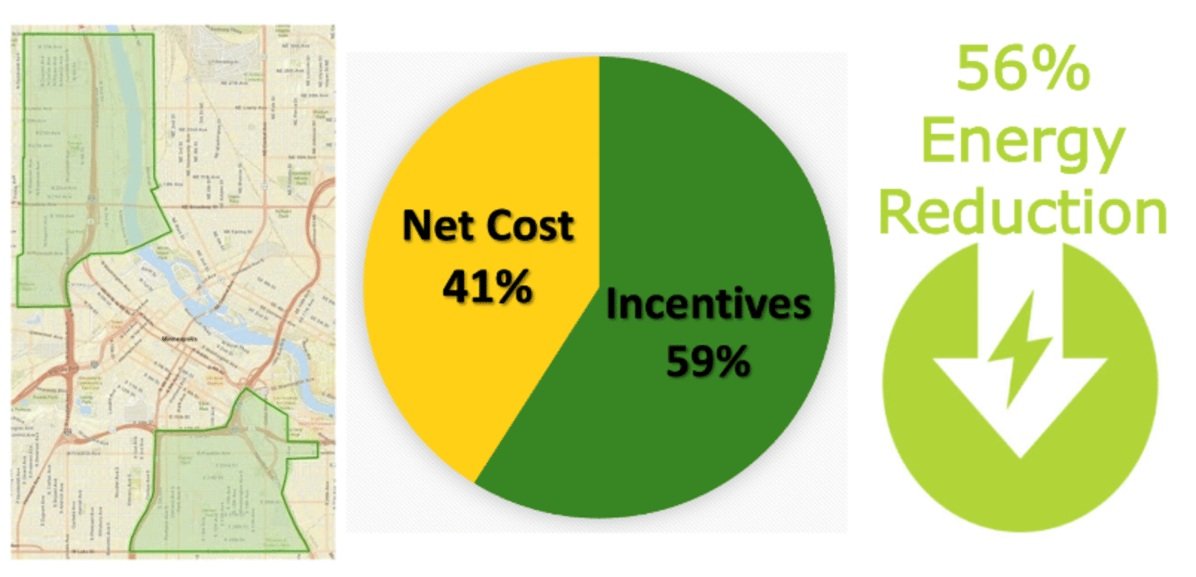

Solar Renewable Energy

Solar arrays can help your organization become energy independent and resilient, generating power to offset utility costs, and generating a range of rate-, tax- and other incentives, often with payback under 10 years. Other renewable energy sources, including geothermal and wind, could bolster generation and savings.

EV Charging Stations

The growth of electric vehicles (EVs) and the behavior of EV drivers are increasing the demand for electric vehicle charging stations. By providing charging stations, you will be positioned as a leader committed to both environmental sustainability, your customers and employees. Utilities are evolving their energy efficiency programs to provide incentives for EV charging stations - and some will cover the majority of the cost of equipment, installation, or both!

Consultation & Services

Building Energy Assessments

With a site visit and walk-through, Minify Energy will unearth and help prioritize projects that have the most value to your organization’s needs, looking across utility bills, HVAC, controls, lighting, envelope, renewable generation and other energy and environment factors.

Utility Bill Audits & Analysis

Audit your bills for potential errors, tax savings, and rate changes that can net you thousands in potential immediate and ongoing savings. Minify provides utility bill analysis and savings for buildings in all 50 states. And with a guaranteed savings model there are no upfront costs for this service.

Project Management

Minify is an all-in-one turnkey contractor and installer of energy efficiency projects that help you save money by saving energy. We identify, prioritize and implement projects from start to finish. Think of us as a general contractor of energy efficiency projects.

From the Blog: